Find out more about agrifood in the south of italy

Italian AgriFood on the Rise

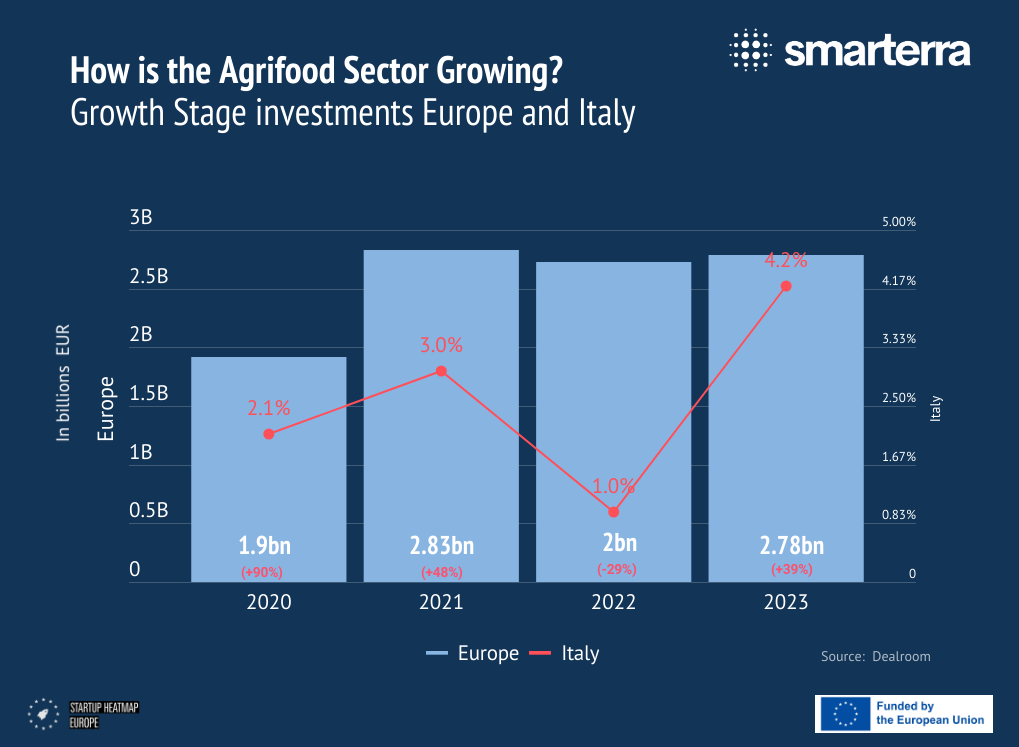

Italian Agrifood plays a significant role in the European sector and has surpassed the continent in growth in 2023. The Smarterra project aims to solidify the Italian agrifood landscape and appeal to global investors, enhancing today’s food system towards health and sustainability using local food ecosystems supported by advanced science, technology, and entrepreneurship.

The Smarterra activities are funded under the project SMart Agriculture Food Innovation Ecosystem (SMAFINE), which is funded by the European Union’s HORIZON EUROPE research and innovation programme under grant agreement No 101114215.

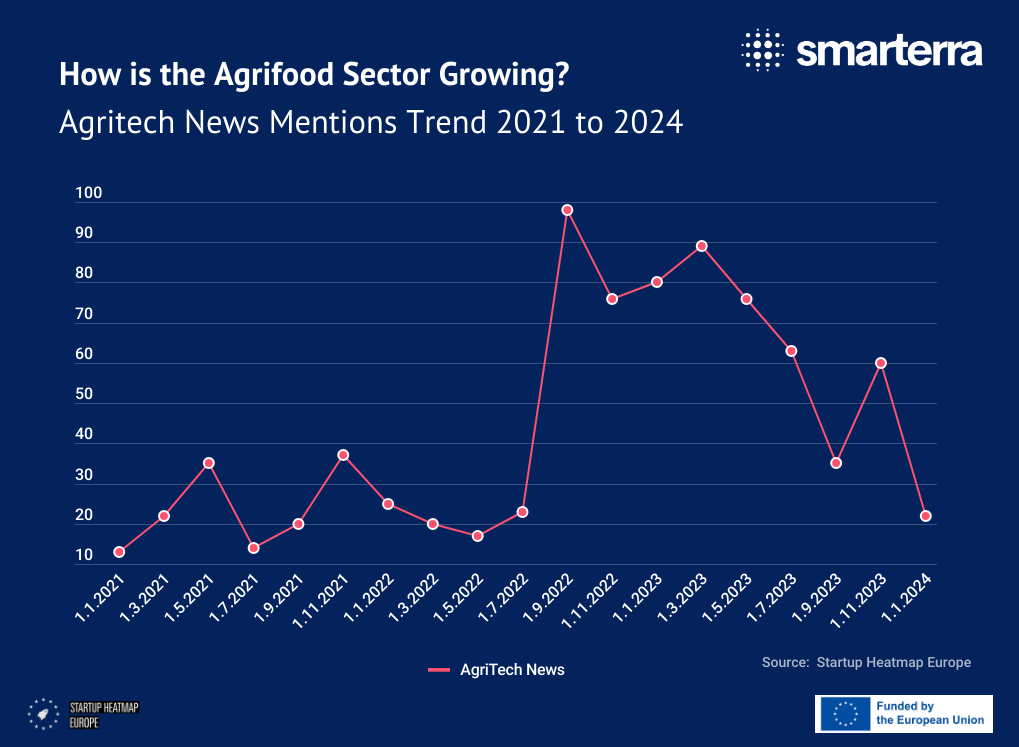

Agrifood is here to stay – since 2022 the topic is omnipresent

This line chart represents the growth of the agrifood sector based on agritech news mentions trend from 2021 to 2024 in Europe.

Media coverage is a good proxy for public and investor interest. This graph shows how agritech has gained attention over the years, reflecting its growing importance and the increasing awareness of its potential.

Top Italian Agrifood Startups

Alberami

Alberami is an innovative Italian startup founded in 2021. It operates in the environmental sustainability sector. Its primary mission is to combat climate change by offering a platform enabling individuals and businesses to offset carbon dioxide (CO2) emissions. The company operates in the broader carbon offsetting and sustainability market.

eVja

eVja founded in 2015, comprises a team of young professionals passionate about agriculture. The project focuses on supporting growers in monitoring and protecting their crops through constant innovation, research, and development. Collaborations include prominent institutions such as the University of Naples Federico II, the University of Pisa, the University of Almeria, the CNR, and CREA, alongside national and international stakeholders committed to advancing agricultural best practices.

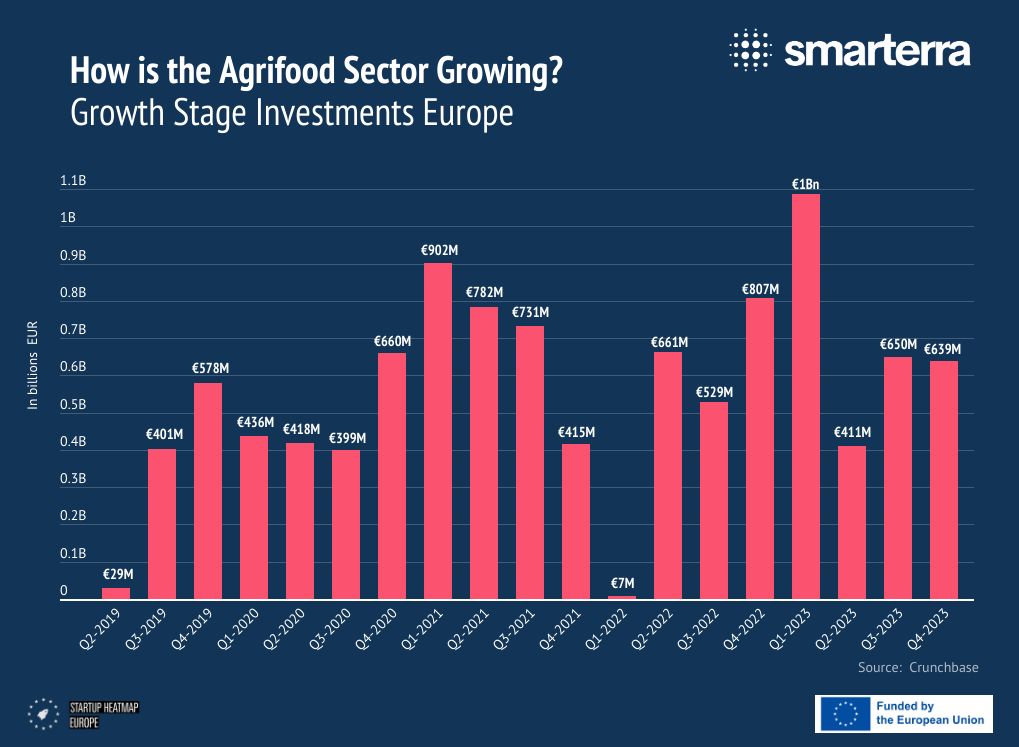

Every 3 months, Europe sees hundreds of millions invested in Agrifood

This graph shows the growth stage agrifood investments in Europe by quarter from 2019 to 2023.

Breaking down the data quarterly, we can observe more granular investment patterns and identify key periods of growth and potential contributing factors. This helps to understand the investment dynamics within each year.

Agrifood News in Europe

New Products are the biggest sector, followed by Agricultural Processes

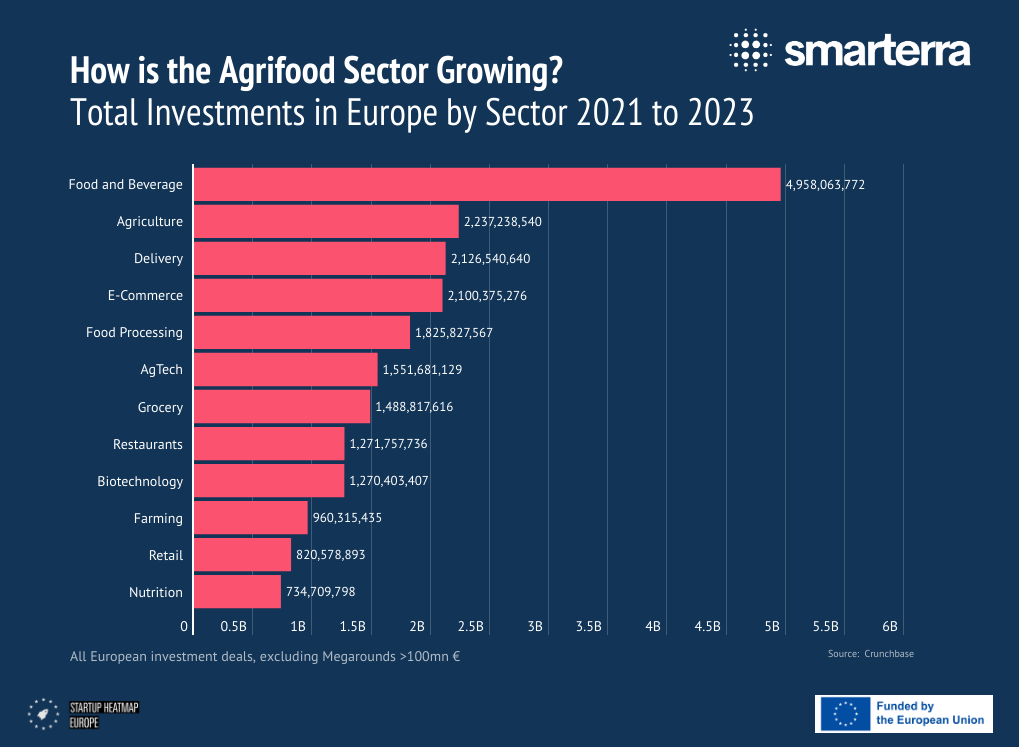

This graph shows agrifood early-stage investments by sector from 2021 to 2023 in billion EUR.

By breaking down investments by sector, we can identify which sub-sectors within agrifood are attracting the most capital, indicating areas with the highest innovation potential and investor confidence.

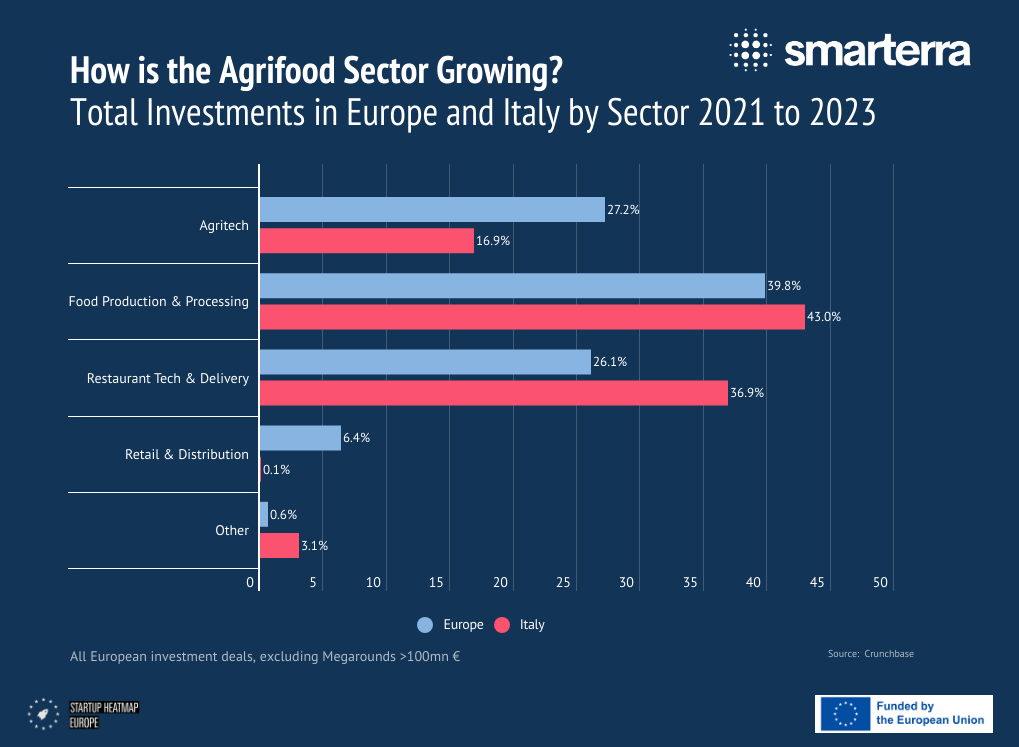

Italy plays a particular strong role in Food Production & Processing

This graph shows total investments in Europe and Italy by sector from 2021 to 2023.

Focusing on a more recent timeframe, this visualization provides insights into sector-specific growth within the agrifood industry, with a particular emphasis on Italy, a significant player in Europe’s agrifood market.

Explore Italian AgriFood Innovation Places

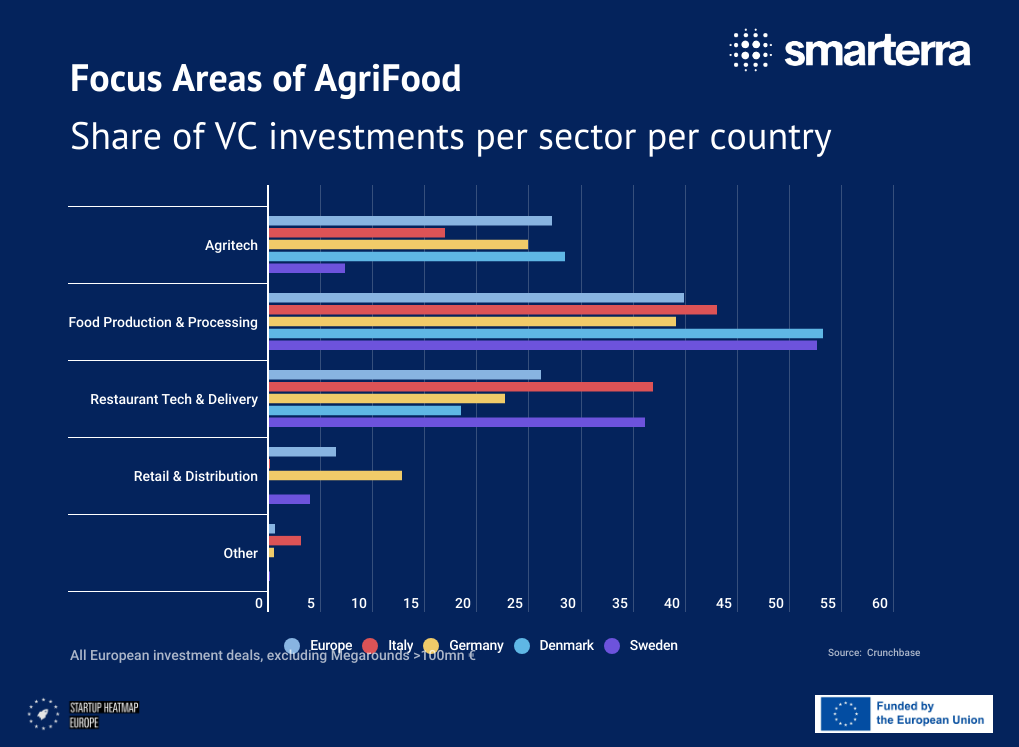

Sweden, Denmark and Germany are Benchmarks for Italy

Looking at the country profiles we find that Sweden and Denmark are also heavily focused on Food Production & Processing. Germany outperforms Italy in the agricultural technology space.

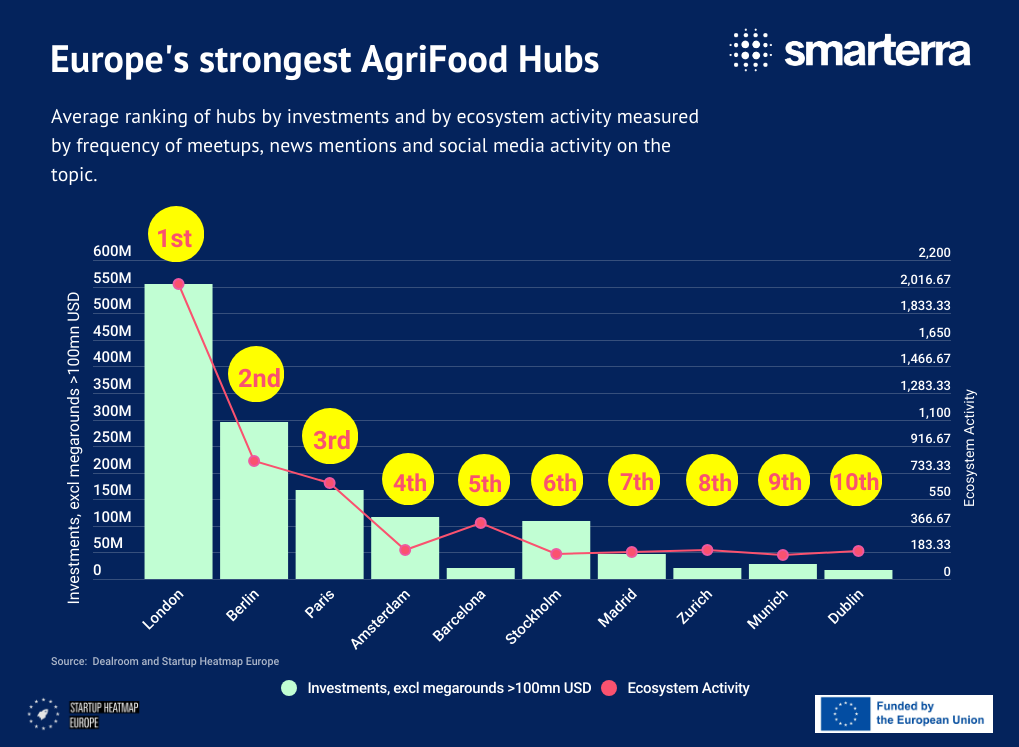

But Italian hubs don’t make the top 10 Agrifood Hubs list Yet

This graph shows the most active cities by investments and ecosystem activity in 2023 in agritech, highlighting the citywide distribution of investments and the connection between news activity.

Italian cities miss the top 10, but Milan ranks 14th, Turin 16th and Rome 18th.